M&A Deal Intelligence Agent

Track, analyze, and compare mergers and acquisitions with contextual insights and source-level traceability.

Challenges

Deal execution workflows break when the volume of documents in a virtual data room (VDR) exceeds the review capacity of the deal team. Intelligent automation is required to assess valuation risks without delaying close timelines.

Data Room Overload

VDRs contain thousands of unorganized files, PDFs, scans, and spreadsheets. Manually indexing and triaging these documents creates a bottleneck at the start of every deal.

Hidden Liability Risks

Critical clauses like "Change of Control," "Assignment," or pending litigation are buried in standard contracts. Manual sampling misses these "deal killers," exposing the buyer to post-close liabilities.

Synergy Blind Spots

Identifying overlapping vendor contracts or duplicate operational costs requires cross-referencing thousands of documents. Manual methods fail to quantify these synergies accurately before day one.

Integration Latency

The handoff from diligence to integration is fractured. Critical data discovered during diligence remains trapped in static reports, slowing down Day 1 execution.

What Defines Us

Redefining investment operations with semantic intelligence that turns chaotic data rooms into structured, queryable deal insights.

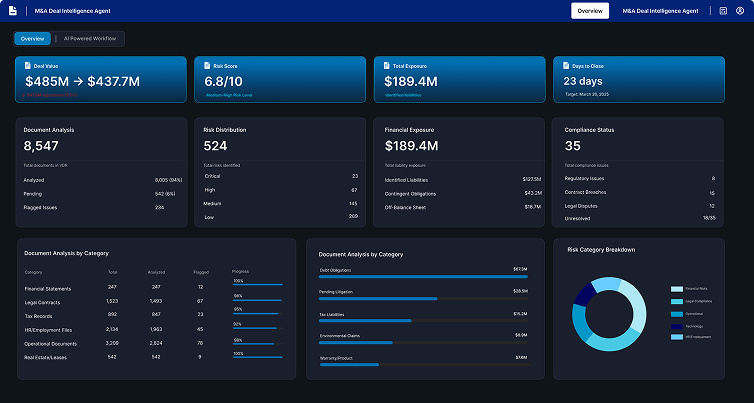

AI-Powered Deal Analysis for Accuracy and Scale

Deploy intelligent agents to autonomously ingest and classify the entire contents of a Virtual Data Room (VDR). The system identifies, categorizes, and extracts data from contracts, financial statements, HR records, and IP filings simultaneously, regardless of file structure or quality.

Ensure valuation integrity through automated risk validation that flags clauses impacting deal terms. The platform handles exceptions by isolating non-standard agreements for senior counsel review while prioritizing high-risk findings. Beyond automation, the solution delivers intelligence by mapping interdependencies such as identifying which customer contracts terminate upon acquisition providing a clear view of revenue at risk and required integration actions.

Insight-Ready Due Diligence – No Manual Triage

Instantly convert raw VDR data into structured risk reports and synergy models. Achieve 100% review coverage that safeguards valuation and accelerates the path to close.

reduction in diligence cycle time

contract review coverage (vs. sampling)

increase in deal capacity per team

post-close "Change of Control" surprises

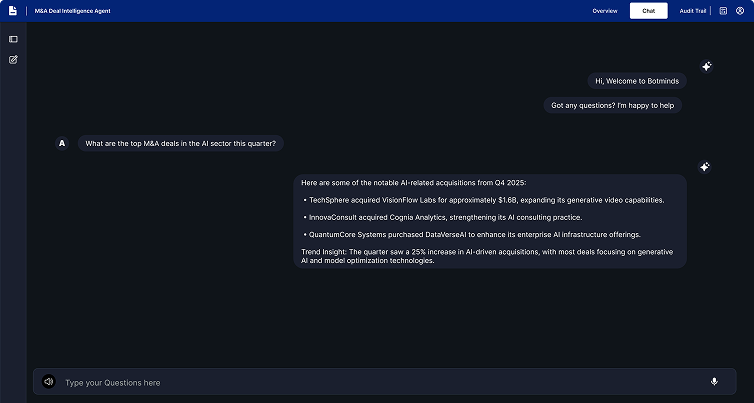

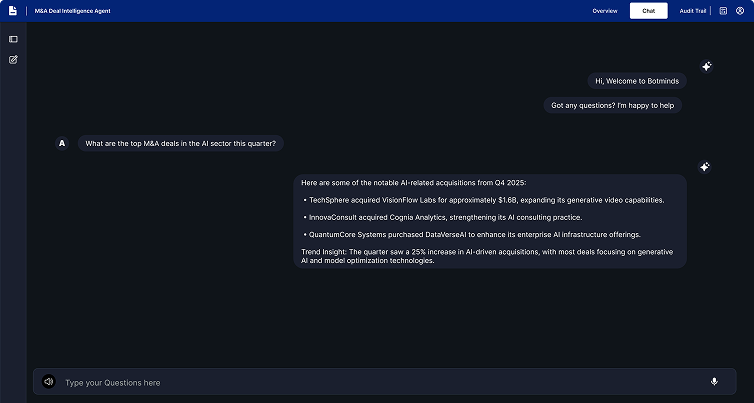

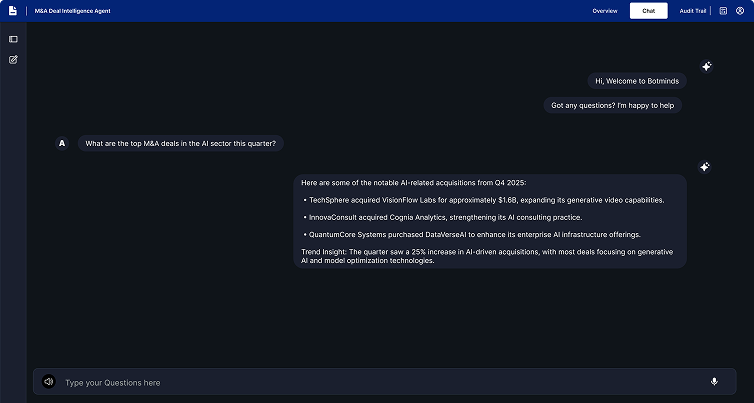

See M&A Intelligence in Action

Explore how filings, announcements, and market data are consolidated into dynamic deal profiles — every metric and milestone traceable to its verified source.

Spot "Deal Killers" Early

Automatically surface and rank high-risk liabilities, such as uncapped indemnities or exclusivity breaches, before creating the binding offer.

Quantify Synergies Instantly

Aggregate vendor spends and overlapping contracts to build accurate, data-backed integration cost models.

Accelerate Q&A Cycles

Answer diligence questions in minutes by using semantic search to locate specific evidence across the entire data room.

Bridge Diligence to Integration

Convert risk findings directly into a "Day 1" action plan to ensure operational continuity immediately after closing.

Get the answers you need

Find clarity on our solutions, capabilities, and how we can support your business.

The agent ingests and extracts from SEC filings, press releases, financial disclosures, identifying entities, structures, valuations, and timelines with full traceability.

Every extracted element is linked to its source document, enabling audit-ready verification and reducing errors in deal analysis.

Yes, it supports precedent transaction benchmarking by sector, region, and structure for informed comparative analysis.

Ready to Adapt, Grow, Optimize

or Disrupt With Us?

Book a 30-minute consultation to find the best starting point